We all know that the only two certainties in life are death and taxes. Even after we’ve gone, taxes are still levied against our estate. The more money we make, the more money the taxman looks to take. Tax can be a serious stumbling block in our financial mindset, especially when we think about all […]

Category Archives: Blog

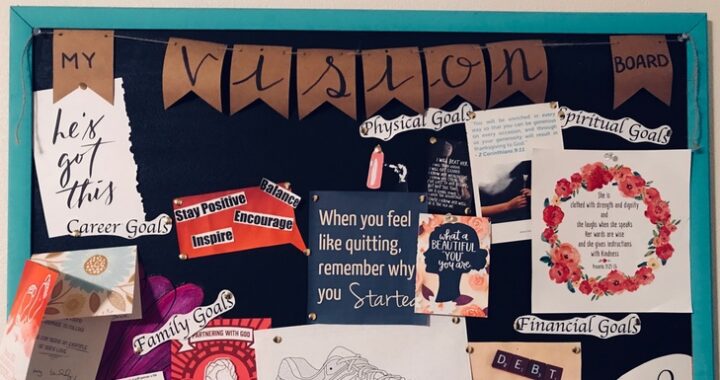

The importance of being intentional

If we don’t stand for something, we will fall for anything. Essentially, our actions will either result from what we choose, or what is chosen for us. Our days are packed full of communication and actions. From the moment we engage with our mobile device or open our emails, messages begin to stream in and […]

Four ways to measure your fortune

We often don’t worry about something until we realise that it’s limited. If we have lots of something, it’s a fortune. If we don’t, it can become a focus of concern and anxiety. Young children generally don’t worry about much if their needs are met. With access to their parents’ love, attention and confidence, children […]

The best time to live

“Remember the past, plan for the future, but live for today, because yesterday is gone and tomorrow may never come.” The best time to live is in the present. It’s easy to get lost in a daydream of how life could have been different or how good life used to be. It’s equally easy to […]

Catastrophising and how to manage it

Have you ever gone down a rabbit hole on social media? You know, that moment when you see something triggering and you click on it, and then scroll down through the comments, becoming wholly engrossed in a conversation that turns out to be a waste of time and emotional energy. While we’re in that moment, […]

Ask yourself these questions BEFORE switching funds

As financial planning conversations deepen and explore more value, we find ourselves moving from the empirical to the emotional, from processes to perceptions and from products to people. It’s an enlightening journey that takes us away from numbers and allows us to reflect and reconstruct our future planning approach. But, it’s also extremely challenging as […]

How much do you need?

One of the hardest questions to answer when it comes to financial planning is: How much do I need? There are two ways we can look at this. Either, I believe that my external circumstances will eventually reach a point where I have earned enough, and I’ll finally feel that I have enough. Or, I […]

Making goals easier to achieve

“If I had a penny for every time I put something off until tomorrow, and never got to it… I’d put them all in a sock and hit myself with it.” Unknown In our digital age, it has become increasingly easy to create lists of things to do and remember. We can just call out […]

Sustainable sanity

When we stand together, we can succeed together. We can support and encourage one another. But this only happens in our smaller, more intimate groups. The fourth industrial revolution has slowly edged us into a communication environment that is overwhelmed with information. We are learning that whilst we can stand together in powerful support, we […]

How much time is your money worth?

As we build businesses and seek to create various income opportunities, we are always confronted with the challenge of pricing. It’s a challenge because all of our situations are different. Those with qualifications and experience often charge more for their time. But it’s not a sure way to work out billing and costs; sometimes people […]