Regardless of what words we want to put to our journey with our money, there are a few realities that we need to face. First – everything we do is linked to money, whether we pay for it ourselves or rely on a benefactor. Second – some of our wealth-generation depends on luck and circumstance, […]

Category Archives: MARKET

What a better financial plan could look like

It’s easy to think about a financial plan and consider the elements that typically go into it. For instance, we could picture a plan that consists of a retirement savings product, life and health insurance, investment portfolios, and maybe a few things like trusts, wills and estate plans. Or, we could think about what a […]

Marketing yourself beyond 2022

In the next few years, we are likely to see a significant increase in small businesses, from home enterprises to startups. Many people have had to create sideline income or recover from losing their jobs in a shrinking job market. Jobs seeing the fastest decline are in production or administration support, primarily due to automation […]

Just one more

They say that getting old happens slowly, and then all at once. Most of the change around us occurs so gradually that we barely notice it; ageing, losing or gaining our fitness, losing or gaining weight, intimacy in relationships, and debt and investing. These are some of the areas of incrementally-unnoticeable change with which we’re […]

Feelings – thoughts – actions

‘Your mind will take the shape of what you frequently hold in thought,’ Marcus Aurelius. How we engage with our money reflects what’s going on inside our heads, which is an extension of what’s going on inside our hearts. They’re all connected. Our feelings affect our thoughts, which in turn direct our actions – but […]

Don’t let tax get you down

We all know that the only two certainties in life are death and taxes. Even after we’ve gone, taxes are still levied against our estate. The more money we make, the more money the taxman looks to take. Tax can be a serious stumbling block in our financial mindset, especially when we think about all […]

The best time to live

“Remember the past, plan for the future, but live for today, because yesterday is gone and tomorrow may never come.” The best time to live is in the present. It’s easy to get lost in a daydream of how life could have been different or how good life used to be. It’s equally easy to […]

Ask yourself these questions BEFORE switching funds

As financial planning conversations deepen and explore more value, we find ourselves moving from the empirical to the emotional, from processes to perceptions and from products to people. It’s an enlightening journey that takes us away from numbers and allows us to reflect and reconstruct our future planning approach. But, it’s also extremely challenging as […]

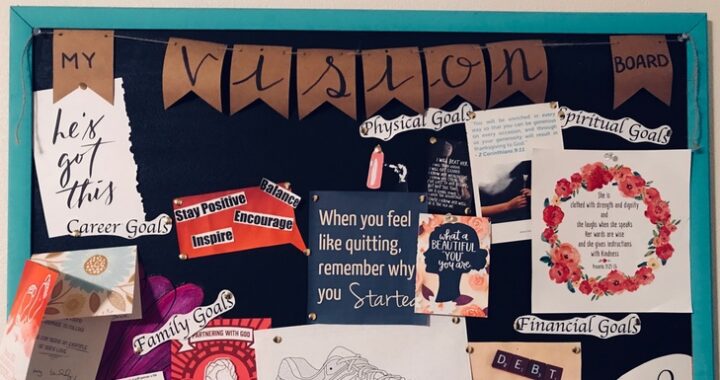

Making goals easier to achieve

“If I had a penny for every time I put something off until tomorrow, and never got to it… I’d put them all in a sock and hit myself with it.” Unknown In our digital age, it has become increasingly easy to create lists of things to do and remember. We can just call out […]

How much time is your money worth?

As we build businesses and seek to create various income opportunities, we are always confronted with the challenge of pricing. It’s a challenge because all of our situations are different. Those with qualifications and experience often charge more for their time. But it’s not a sure way to work out billing and costs; sometimes people […]